December 10, 2008

The Misfits:

Race To Subsidize Movie Industry

Sucks In Miscast Texas Taxpayers

By Beryl Lipton

State politicians gathered in front of a movie backdrop in June 2007 as Governor Rick Perry—the well-coiffed lead man—signed into law Texas’ first taxpayer subsidies for producers of films, television shows, TV ads and video games. Austin Rep. Dawnna Dukes, an author of the new Moving Image Industry Incentive Program,1 marked the occasion by proclaiming, “The days of missed opportunities are finally over.” 2 In fact, the era of “missed opportunities” and government handouts had just begun. The film industry now plans to lobby lawmakers this January to triple the subsidies that they just secured last session. It is all part of a Hollywood remake of the War Between the States and it is a battle that the winner is sure to lose.

The federal government and a majority of the states now offer incentives to produce films within their borders. Even the recently enacted federal bank bailout plan included expanded tax subsidies for the film industry—an industry that boasted a record $9.5 billion in domestic ticket sales last year.3 Once expected to distract and entertain the masses during economic recessions, Hollywood moguls now apparently are cast as part of the economic-recovery team. Does the race to subsidize this industry strengthen or weaken state economies? Where does subsidizing movies, video games, TV shows and commercials rank among the competing priorities of pressing human needs?

Under the new subsidy law, Texas taxpayers pay five percent of anything that qualifying media projects spend here (the state has approved $10.1 million in subsidies to date). Texas also exempts the industry from state sales taxes. Few people realize that most of the media-subsidy applications that Texas has approved are to produce TV ads, many benefiting the world’s largest corporations.

Advocates of these incentives say that they create jobs, attract out-of-state investment and boost Texas tourism.Yet the subsidy package that Texas approved just last year already is hopelessly outdated, says Texas Film Commission Director Bob Hudgins. Producers are flocking to other states that pay up to 42 percent of production costs. Hudgins says that Texas’ talented film crews and Austin’s hip reputation would successfully attract the industry if producers were not chasing bigger subsidies elsewhere.4 But Hollywood producers roam the globe in search of the taxpayers who will pay the biggest bounties.

In fact, tripling Texas’ subsidies would not make Texas competitive with still-more aggressive states, some of which now worry that they have given away too much. Rhode Island, Michigan and Louisiana have all made moves to rein in overly generous subsidies, concluding they have not delivered all the promised jobs and revenues.5 While star-struck officials across the country once lined up to dole out these subsidies, signs of fatigue are appearing in the race to the bottom.

Michigan state Senator Nancy Cassis expects a bipartisan move to cap her state’s record 42 percent film subsidies. “These are not long-term jobs,” Senator Cassis told the New York Times. “If one state offers more, they’ll be out of here before you can say ‘lickety-split.’” In an early analysis of its 25 percent rebate, Massachusetts’ Revenue Department estimated that the state is unlikely to recoup more than 23 cents of each subsidy dollar it spends. “There is no evidence yet that this is a particularly efficient or effective way to create jobs,” observed Massachusetts Budget and Policy Center Director Noah Berger.6

Canadian Bacon

The Canadian Government fired the starting gun for the film-subsidy race in 1997 by enacting industry tax credits that covered 11 percent of the employment costs paid to Canadian residents or corporations. The combinations of these subsidies and the then-weak Canadian dollar prompted many U.S. production companies to migrate northward.7 Oklahoma retaliated in 2001 by enacting the Compete with Canada Act, which offered a sales-tax exemption and a subsidy on 15 percent of all money spent in the state.8 This is the same subsidy level that industry lobbyists plan to seek when the Texas Legislature convenes in January. Yet much has changed in eight years. Slithering out of the bayou in 2002, Louisiana offered a sales-tax exemption and tax credits equal to 25 percent of production costs. These tax credits could be converted to cash by trading them on the open market. The production budget for films shot in Louisiana shot up from $12 million in 2002 to $355 million in 2004,9 earning the Cajun State the moniker “Hollywood South.” Today 40 states offer some type of film incentives, as California struggles to retain a major industry (it offers just a 5 percent sales-tax exemption on postproduction equipment). Governator Arnold Schwarzenegger told the producers of the forthcoming “Terminator Salvation” that he would make a cameo appearance in the film if they shot it in his state. Instead, they sought salvation in New Mexico, which offered to pay one-quarter of their production costs.10 |

Remember the Alamo!

The Economic Development Quarterly referred to Texas in 2000 as a film-industry growth area, citing its sales-tax abatements and hotel-tax breaks.11 Yet Texas has lost ground ever since. Spending on studio feature films in Texas almost doubled from 1998 to 2003, hitting a peak of $95 million. This spending plummeted to just $800,000 in 2007. Meanwhile, Texas film crews followed the studios to states offering bigger handouts; studio feature-film jobs in Texas dissolved from its height of 1,350 in 2003 to just 60 in 2007.12

Texas’ current subsidy program pays five percent of all in-state spending to qualifying projects that produce films, television programs, commercials or video games.13 At least 80 percent of a project’s production days must occur in Texas; 70 percent of paid crew members must be Texans. Qualifying feature films and television programs must spend at least $1 million in-state; commercials and video games must spend a minimum of $100,000. Texas also grants sales-tax exemptions on production-related purchases.14 It is difficult to gauge the impact of this tax break. The state has no reliable way to keep track of what purchases are eligible and does not track this exemption at the register.

Media-Subsidy Applications Approved in Texas

|

By October 15, 2008, the state has awarded more than $10 million to 160 projects.15 The biggest grants have been for expensive feature films and television programs. Texas also became one of the first states in the country to approve video-game subsidies in 2007. Yet at least 10 states now subsidize the gaming industry and Governor Perry recently said that Texas must up the ante to stay in the game.16

Most Expensive Projects

|

Fortune 500 on the Dole

Subsidy promoters are apt to talk about high-profile programming, such as the television show “Friday Night Lights.” As a result, few people are aware that Texas taxpayers help finance the commercials that interrupt such programs. In fact, 75 percent of the media-subsidy applications that Texas has approved are to produce TV commercials. To date, taxpayers are on the hook to pay $1.6 million for 120 commercial spots. Many of these taxpayer-supported TV ads promote national retailers and multi-national corporations such as Wal-Mart and Sony. At least 49 of these grants for TV commercials benefit either “Fortune 1000” or “Fortune Global 500” corporations.

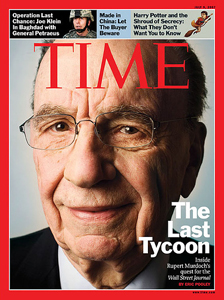

The accompanying table lists the 54 grants benefiting companies on the “Fortune 1000” or “Global 500” list. The top three recipients owe their rankings to the fact that they are media companies receiving grants to produce film or television programming, as well as commercials. The rest of the corporations on the list have been approved exclusively for TV-commercial subsidies.

Grants Approved for Fortune 1000

|

| Parent Company of Beneficiary |

No. of TV Commercials |

No. of Films/ TV Programs |

Estimated Grant Amount |

| News Corp. | 1 |

3 |

$1,096,945 |

| Sony | 4 |

1 |

$340,692 |

| Time Warner | 1 |

1 |

$309,272 |

| Hasbro | 13 |

0 |

$263,451 |

| Electronic Arts | 3 |

0 |

$67,005 |

| Publix | 3 |

0 |

$56,759 |

| AT&T | 4 |

0 |

$46,089 |

| Toyota Motor | 2 |

0 |

$31,529 |

| Disney | 1 |

0 |

$29,302 |

| ConocoPhillips | 1 |

0 |

$19,297 |

| Dick's Sporting Goods | 1 |

0 |

$18,726 |

| Walmart | 2 |

0 |

$16,501 |

| Royal Dutch Shell | 1 |

0 |

$14,337 |

| Nokia | 1 |

0 |

$10,833 |

| Comcast | 1 |

0 |

$10,321 |

| JC Penney | 1 |

0 |

$10,000 |

| Viacom | 1 |

0 |

$9,968 |

| Dell | 1 |

0 |

$9,750 |

| Delhaize Group* | 1 |

0 |

$9,726 |

| Blockbuster | 1 |

0 |

$9,500 |

| Pepsi - Unilever | 1 |

0 |

$9,183 |

| Honda | 1 |

0 |

$9,134 |

| Royal Phillips | 1 |

0 |

$8,742 |

| Bayer | 1 |

0 |

$6,649 |

| Hyundai | 1 |

0 |

$5,900 |

TOTALS |

49 |

5 |

$2,419,611 |

Note: These are conservative numbers since information from the Texas Film Commission did not name the ultimate beneficiary of each subsidized project.

*Belgian company that owns Food Lion grocery chain.

|

Topping this list of corporate welfare recipients is Rupert Murdoch’s News Corp., which owns Fox Studios. Texas’ largest approved media subsidy to date is to pay $873,298 in tax dollars to help shoot one season of Fox’s “Prison Break” television show. The following season, “Prison Break” escaped and fled across Texas state lines, returning home to Los Angeles. Texas also approved $213,142 in subsidies for two seasons of the Fox show “Cristina’s Court” and another $10,505 for a Fox commercial. Texas awarded subsidies to two other production companies to make both programming and commercials. Texas approved a $277,256 subsidy for Sony’s “Open Season” cartoon and another $63,436 for Sony commercials. Time Warner has qualified for $304,000 from Texas taxpayers for an HBO biopic on Dr. Temple Grandin—an expert on autism and the humane treatment of livestock—and for another $5,272 toward a commercial shoot. |

Texas Motion Picture Alliance

Film, video and digital media advocates—including leading local filmmakers Richard Linklater and Robert Rodriguez—formed the Texas Motion Picture Alliance in 2006 to promote subsidies for their industry. CBS and Fox Studios have also advocated for the subsidies in legislative hearings. The Alliance, which has reported spending up to $300,000 on 13 lobby contracts, is gearing up for a new legislative push to expand Texas subsidies.

Texas Motion Picture Alliance

|

| Lobbyist | Minimum Value of Contracts |

Maximum Value of Contracts |

| J. Lawrence Collins | $50,000 |

$110,000 |

| Brandon T. Aghamalian | $50,000 |

$100,000 |

| Snapper L. Carr | $0 |

$20,000 |

| Neal T. "Buddy" Jones | $0 |

$20,000 |

| Vilma Luna | $0 |

$20,000 |

| Bill Miller | $0 |

$20,000 |

| Tanya C. Vasquez | $0 |

$10,000 |

TOTALS: |

$100,000 |

$300,000 |

Several Alliance lobbyists are state-government veterans, having previously held lead roles in the legislature. The Alliance’s top lobbyist, Lawrence Collins, is a former director of the Senate Finance Committee, which recommended the film-subsidy bill to the full Senate. The Alliance’s other lobbyists all work at the firm HillCo Partners. HillCo’s Buddy Jones is an ex-legislator and ex-speaker’s aide. Bill Miller, who co-founded HillCo with Jones, served on Republican House Speaker Tom Craddick’s transition team after the controversial 2002 election that established a GOP majority in the Texas House. Alliance lobbyist Vilma Luna was one of Craddick’s Democratic allies in the House before she joined HillCo in 2006.

Projecting the impact

While the first study of the economic impact of Texas’ film incentives is not expected until December, other states are finding that the cost of attracting major productions is too high. Louisiana recently experienced sticker shock over the $27 million record subsidy bill that it received for the privilege of hosting Brad Pitt’s next $167 million movie, “The Curious Case of Benjamin Button.” Louisiana has since tightened its restrictions on how much of a proudction's budget qualifies for subsidies. Recession-reeling Michigan now boasts the nation’s highest film subsidies, offering a tax-credit covering 42 percent of in-state production expenses. Some estimates suggest that this generous bounty could cost the state more than $200 million a year.17 Michigan recently demonstrated that it had whipped Texas at movie welfare when it landed “Whip It,” Drew Barrymore’s forthcoming film about Austin Rollergirls.

Taxpayers around the country are reimbursing producers for everything from crewmember meals to movie-star salaries. With its 25 percent subsidy on in-state production expenses, Massachusetts found that much of the money that it paid went for the salaries of out-of-state movie stars, who took their pay home.18 There also is evidence that the budgets that some producers submit for subsidy reimbursements are docudramas—only loosely based on actual events. In January a Louisiana judge is scheduled to sentence that state’s former film commissioner to up to 15 years in prison for taking bribes from film producers to pad their subsidies.19

With states now offering to pay 25 percent to 40 percent of production costs, there is little evidence that such handouts are fiscally sound. Studying $121 million in film credits awarded in 2006, the Louisiana Legislative Fiscal Office found that the state recovered just 18 percent of this amount through expanded economic activity. The Massachusetts Budget and Policy Center recently reported that the film subsidy rate there is five times higher than what the state offers for developments in blighted areas.

Two neighboring states now are the biggest poachers of Texas’ film industry. Louisiana offers state tax credits equal to 25 percent of total production expenditures, including payroll.20 If the production company itself does not have state tax liabilities, it can sell its tax credits to brokerages for approximately 80 cents on the dollar. New Mexico has no need for such brokerages. When production companies working there lack state tax liabilities, the state writes them a check for the full value of their tax credits.

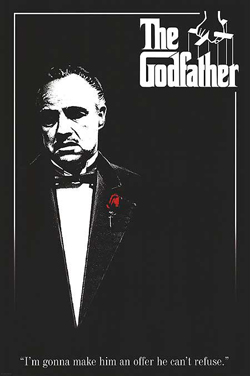

Texas’ relatively small payments—covering 5 percent of production costs—are outgunned by what other welfare states provide. To compete, however, it would not be enough for Texas just to boost its subsidy rate. In a testament to how fast the “race to the bottom” has advanced, staying competitive now means doing away with fiscal safeguards that prevent subsidy excesses. Texas likely cannot compete if it refuses to subsidize salaries and wages paid to out-of-state residents. Nor can the Lone Star State compete if it keeps refusing to subsidize the salaries of resident film stars once they surpass $1 million. A competitive Texas also would need to repeal caps that stop subsidizing film-project budgets that exceed $2 million. In today’s environment, being competitive means always saying “Yes.” When the producers come around with Don Corleone-style offers to make movies in your state, being competitive means not being able to refuse. Forget about it. |

Some will rob you with a fountain pen. - Woody Guthrie

“Watch Your Assets” is a Texans for Public Justice project.

Lauren Reinlie, Project Director.

Author Beryl Lipton was a summer intern at Texans for Public Justice.

Endnotes:

1 HB 1634.

2 “Setting the stage to lure film productions.” Austin American-Statesman. June 8, 2007.

3 “Tax breaks big and small sweeten financial bailout,” Associated Press. Oct. 4, 2008. "Bailout gives U.S. production push," Variety. Oct. 30, 2008.

4 Bob Hudgins interview. June 27, 2008.

5 “A Report on the Massachusetts Film Industry Tax Incentives,” Massachusetts Department of Revenue.

March 2008.

6 “Jitters Are Setting in for States Giving Big Incentives to Lure Film Producers,” New York Times. Oct. 12, 2008.

7 “Hollywood Jobs Lost to Cheap (and Chilly) Climes," New York Times. May 10, 1999.

8 “Abandoning the Nest.” The Austin Chronicle. May 23, 2008.

9 "Film and Video Tax Incentives: Estimated Economic and Fiscal Impacts," Louisiana Legislative Fiscal Office. March 2005.

10 “Lack of Film Incentives in California not a Draw,” Hollywood Reporter. July 24, 2008.

11 “Filmed Entertainment and Local Economic Development: Texas as a Case Study,” Economic Development Quarterly. Vol. 14, No. 4.

12 "Texas Media Industries Ten-Year Economic Impact Chart," Texas Film Commission. June 26, 2008.

13 This includes wages paid to Texas residents. “Setting the stage to lure film productions.” Austin American-Statesman. June 8, 2007.

14 For more information, see Texas Film Commission Production Incentives Overview.

15 The Texas Film Commission reviews applications and approves them before the project is completed. Once completed, the state must review final documentation to determine whether the project met certain criteria. After this review process, the state issues a check to the production company. So far, the state has paid only $126,000 of the $10 million awarded. Robert Brown of the Texas Film Commission estimates that 90 of the 160 approved projects have been completed and have submitted their paperwork, but are awaiting final review by film commission staff before payment can be made.

16 “Perry says Texas Will Woo Video Game Companies Harder,” Cox News Washington. July 16, 2008.

17 “Jitters Are Setting in for States Giving Big Incentives to Lure Film Producers,” New York Times. Oct. 12, 2008.

18 “Rich Stars Pocket Subsidies, State Says.” The Boston Globe. May 21, 2008.

19 “Jitters Are Setting in for States Giving Big Incentives to Lure Film Producers,” New York Times. Oct. 12, 2008.

20 This rate jumps to 35 percent for payroll to Louisiana residents.

21 Texas Film Commission