March 4, 2009

Wal-Mart Deep Discounts

the DFW and Houston Areas

By Paul Heberling

Slashing prices on the way to becoming the planet’s biggest corporation, Wal-Mart has not skimped on everything. The company is the retail industry’s top spender on Washington and Austin lobbyists,1 who seek to minimize Wal-Mart’s taxes even as they hustle Wal-Mart subsidies that come courtesy of other taxpayers. To explore this situation, Watch Your Assets sought to compile a comprehensive view of the subsidies that Wal-Mart has obtained from local governments across Texas. This goal proved to be elusive. While Texas law requires local governments to report such subsidies to the Texas Comptroller, many jurisdictions simply fail to comply with this requirement.2

Unable to canvass every local government in the state, researchers requested subsidy information from the cities and counties that surround the five largest metropolitan areas: Austin, Dallas-Fort Worth, El Paso, Houston and San Antonio.3 Twelve jurisdictions reported that they provided major public support to Wal-Mart over the past decade. Because four Wal-Mart projects received both city and county aid, these subsidies benefited eight Wal-Mart projects, which collectively received support worth more than $33 million.4 |

A Wal-Mart tractor-trailer heads toward a regional distribution center in Hurricane, Utah. New York Times, November 13, 2007.

|

In 2004, Wal-Mart landed the mother-of-all subsidy deals for a mega-distribution center east of Houston. Neither Chambers County nor Baytown, where that facility is located, reported subsidizing this project. Instead, the Texas General Land Office (GLO) spearheaded this Wal-Mart handout.5 Although not formally part of this study, the sheer size of the Baytown deal demands mention. To reduce its dependence on expensive, clogged shipping ports on the West Coast, Wal-Mart built the largest U.S. distribution center serving a single company in Baytown.6 This behemoth boasts 4 million square-feet of warehouse space on 474 acres. To dodge property taxes on this complex, Wal-Mart sold it for $100 million to the GLO’s tax-exempt Permanent School Fund, which is leasing it back to Wal-Mart for $238 million over 30 years.7

By contrast, this study trolled for local-government subsidies to Wal-Mart projects in Texas’ five largest metropolitan areas. It identified 12 local-government entities that doled out public funds benefiting eight Wal-Mart projects. Except for one retail superstore subsidized by the City of Dallas, all the other subsidies examined here benefited distribution centers—the regional warehouses that feed Wal-Mart stores.

Wal-Mart Subsidies In Major Metropolitan Areas, 1998 to 2008

*Project also got infrastructure freebies such as power, phone, water, sewer or road hookups. |

In its 2004 Wal-Mart study, “Shopping for Subsidies,” Good Jobs First found that Wal-Mart stores often indirectly benefit from deals that local governments extend to developers of malls where Wal-Mart locates its stores.15 These third-party subsidies are beyond the scope of this study.

The Good Jobs First report also found that local governments directly subsidize more than 90 percent of Wal-Mart’s distribution centers. For more than 20 years, Fort Worth-based Carter & Burgess did architectural and engineering design for new Wal-Mart distribution centers. It has continued to do so after California-based Jacobs Engineering Group (now Jacobs Carter Burgess) acquired the Texas company in late 2007.16 In addition to scouting sites for new Wal-Mart distribution centers, Good Jobs First found that Carter & Burgess often initiates subsidy negotiations with local officials.

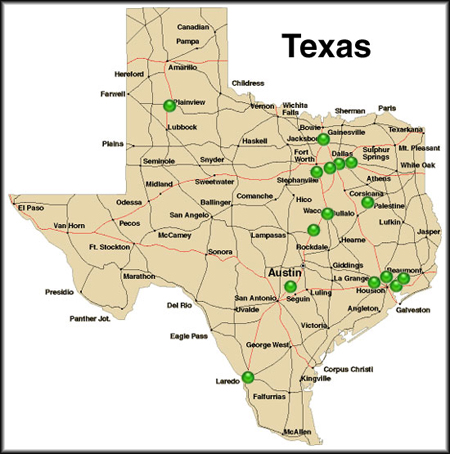

The 15 distribution centers that Wal-Mart has built in Texas surpass what it has built in any other state—including its home state of Arkansas. This reflects Texas’ status as the most populous state located along the nation’s central meridian. The distribution of Wal-Mart’s Texas distribution centers similarly reflects the fact that 45 percent of Texans live within 50 miles of I-35. Given that DFW—with one of the nation’s premiere airport hubs—sits on top of this corridor, it’s not surprising that Wal-Mart put five of its 15 Texas distribution centers in that Metroplex area.

Locations of Wal-Mart Distribution Centers in Texas

What is surprising is that every Metroplex-area Wal-Mart distribution center landed public subsidies. Some of Wal-Mart’s DFW-area benefactors can ill afford to forgo any tax revenues. The year after it signed its retail subsidy deal, the City of Dallas slashed spending elsewhere to confront a $64 million budget shortfall.17 A $34 million budget deficit prompted a Dallas County hiring freeze last year,18 even as the mismanaged Dallas Independent School District was forced to dismiss hundreds of teachers.19 A 2007 study by Austin-based Livable City found that Dallas awarded more than twice as many incentive deals as any other major Texas city from 1991 through 2006.20

Wal-mart also built three distribution centers in the Houston metropolitan area.21 This major population center boasts the Port of Houston, which feeds Wal-Mart’s Baytown mega-distribution center. Excluding the state-owned Baytown facility, both of the other Wal-Mart distribution centers in the Houston area received huge subsidies. These perks surpassed what the company received for any of its Metroplex distribution centers except for the one in Cleburne.

Constructing huge stores or warehouses on raw land enormously increases the market value of the property, which ordinarily yields commensurate increases in local-government revenues. Yet local governments agreed to deeply discount a decade’s worth of property taxes on the increased values of seven out of the eight Wal-Mart projects studied here. The biggest tax-abatement giveaways went to the distribution centers in Montgomery County and City of Cleburne/Johnson County. These governments promised not to collect a dime of taxes on the soaring values of Wal-Mart’s distribution centers there for 10 years. Dallas County and the City of Dallas agreed to take a 90 percent haircut on the increased value of the Wal-Mart facilities that they subsidized. The graduated tax abatements that Wal-Mart received for its Sealy and the Terrell facilities both start out in the first year at 100 percent. The abatements for the Terrell center then step down to 10 percent by the tenth year, while those in Sealy descend to 50 percent in the tenth year. Denton County, which drove the hardest abatement bargain, nonetheless agreed to waive 50 percent of the taxes that ordinarily would be levied on the increased value of that property.

Some local officials also gave away land or money to the world’s biggest corporation. As mentioned, Montgomery County abated taxes on the full increased value of Wal-Mart’s New Caney distribution center. In addition, the sales-tax funded East Montgomery County Improvement District donated the land for this facility at an estimated cost of approximately $3 million. With an estimated total subsidy cost exceeding $10 million, the New Caney facility appears to have received the fattest government handouts in this study. The next-largest subsidies were the Cleburne facility, with an estimated $7 million in subsidies and the Sealy distribution center, which surpasses $6 million. The Sealy facility received infrastructure perks from the City of Sealy, Austin County and the Texas Department of Transportation.

In other inducements, the City of Sanger contributed $1 million toward Wal-Mart’s land purchase and Johnson County filled out the paperwork for Wal-Mart to get a $1.5 million grant from the Texas Capital Fund. The City of DeSoto ponied up $100,000 to help an existing Wal-Mart expand onto 11 acres next door. The City of Terrell gave Wal-Mart a plot of land worth $58,000 and Dallas County gave the retail giant $50,000. Finally, Cleburne, Sanger and Montgomery County also donated infrastructure goodies such as utility and road hook-ups. Even local governments that do not agree to subsidize Wal-Mart find themselves paying for infrastructure to manage traffic flows surrounding its stores.22

Most of the development agreements examined here contained job targets ranging from 150 to 600 jobs (see table), though the Denton County/Sanger, Kaufman County/Terrell, and DeSoto deals lacked employment targets. All of the accords except for Montgomery County and DeSoto laid out capital investments that Wal-Mart was expected to make. Similarly, most of the contracts included compliance clauses providing for the termination of the agreement if Wal-Mart did not comply with key provisions.23 However, Watch Your Assets asked local governments to provide any records that document their efforts to monitor Wal-Mart’s compliance with subsidy agreements and received compliance documents for just three of the eight subsidized projects.24 Apparently, few of the governments subsidizing Wal-Mart looked back after approving the handouts.

Loading boxes at a Wal-Mart distribution center. |

This study turned up subsidies for one Wal-Mart store and seven distribution centers. Government officials understandably prefer to subsidize distribution centers over Wal-Mart stores because the warehouses offer full-time jobs that typically pay more than $10 an hour. Yet these massive warehouses have but one purpose: To supply goods to Wal-Mart stores. Numerous studies have concluded that these stores harm or ruin smaller stores that do not receive tax breaks and pay better wages and benefits.25 |

“Wal-Mart workers in California earn on average 31 percent less than workers employed in large retail as a whole,” according to a study by the University of California, Berkeley.26 The consulting firm Retail Forward found that an average of two local supermarkets are forced out of business for every new Wal-Mart super-center such as the one that the City of Dallas subsidized.27 Wal-Mart’s subsidized projects in Johnson County/Cleburne and Kaufman County/Terrell are refrigerated food-distribution facilities that feed these Wal-Mart super stores to the detriment of community grocers. In addition, Wal-Mart’s cost cutting pushes its suppliers to export manufacturing jobs, with the retailer at times explicitly directing suppliers to move production overseas.28

Although Wal-Mart offers health insurance, many employees are unable to afford it and the company employs other gimmicks to minimize coverage.29 “Many Wal-Mart workers rely on public safety net programs—such as food stamps, Medicare, and subsidized housing—to make ends meet,” the Berkeley study found. A former Wal-Mart manager told the PBS show “NOW with Bill Moyers,” that Wal-Mart personnel offices keep lists of public agencies that offer healthcare services in order to refer employees with health problems.30 In Texas, Wal-Mart is No. 1 in the number of its employees whose children are enrolled in the government-sponsored Children’s Health Insurance Program (CHIP), according to the Austin-based Center for Public Policy Priorities.31

As a California county official observed on NOW with Bill Moyers, many hidden costs that Wal-Mart imposes on communities, citizens and taxpayers do not appear on its store receipts.32

Wal-Mart Expenditures on Texas Lobbyists, 1999-2008

Note: Exact contract values unknown since they are reported in ranges

(e.g. “$50,000 to $99,999”).

Some will rob you with a fountain pen. - Woody Guthrie

“Watch Your Assets” is a Texans for Public Justice project.

Lauren Reinlie, Project Director.

Researcher Ishanee Parikh spent an entire summer collecting data for this report as an intern at TPJ.

TPJ thanks you for your contribution to this project.

Author Paul Heberling is an intern at Texans for Public Justice.

Endnotes:

1 During Texas’ 2007 legislative session Wal-Mart spent up to $175,000 on four Texas lobbyists. This was the largest expenditure by a single retailer (though the Texas Retailers Association trade group spent up to $425,000 that year). Wal-Mart’s biggest Texas lobby push occurred in 2005, when the legislature repeatedly convened to revamp property and business taxes. On federal lobbying see, “Wal-Mart Extends Its Influence to Washington,” Mui, Ylan Q. The Washington Post. November 24, 2007.

2 The Property Tax and Redevelopment Act (Chapter 312 of the Texas Tax Code) requires the Chief Appraiser of each taxing unit that enters into a tax abatement agreement to provide the Texas Comptroller a copy of the agreement. (Sec. 312.005 of Texas Tax Code http://tlo2.tlc.state.tx.us/statutes/tx.toc.htm.) Four of the twelve agreements analyzed for this report were not kept in the Comptroller’s registry of these tax abatement agreements according to a response to a Texas Public Information Act request TPJ filed on Sept. 5, 2008.

3 Researchers used the city and county areas as defined by the US Census Bureau’s list of Standard Metropolitan Statistical Areas (SMSA). If a county reported a Wal-Mart project in a smaller city not included in the SMSA list, follow-up requests were sent to that municipality.

4 “Tax Abatement Agreement,” Kaufman County. October 25, 1999.

“Agreement,” City of Terrell. September 30, 1999.

“Tax Abatement Agreement,” Denton County. December 5, 2000.

“Inducement and Development Agreement,” City of Sanger. June 13, 2000.

“Court Order – Order no. 2001 1464,” Dallas County. August 7, 2001.

“2001-113971 – Tax Abatement Agreement,” Montgomery County. December 26, 2001.

“Resolution no. 02-1951 – Real Property Tax Abatement Agreement with Wal-Mart Real Estate Business Trust,”

City of Dallas. June 26, 2002.

“Tax Abatement Agreement,” Johnson County. September 24, 2001.

“Resolution no. RS08-2001-74 – Development Agreement with Wal-Mart Stores East, Inc. for the Cleburne Distribution Center,” City of Cleburne. August 28, 2001.

5 Nonetheless, these local governments all consented to the deal. In a thank-you letter that a Wal-Mart executive sent to Governor Rick Perry about the deal in February 2004, Executive Vice President of Logistics Rollin Ford singled out a number of helpful Baytown and Chambers County officials by name.

6 “With Houston distribution center, Wal-Mart redraws the logistics map,” Pacific Shipper, August 19, 2005.

7 “State buying Wal-Mart warehouses,” Austin American-Statesman, September 1, 2005.

8 Jobs targets in full-time job equivalents.

9 Most subsidy cost estimates by Good Jobs First. www.walmartsubsidywatch.org/index.html

10 Watch Your Assets estimated future subsidy costs using 2008 tax rates and extrapolated tax-assessment values.

11 This grant was reported in Good Jobs First’s study “Shopping for Subsidies.” Dallas officials did not disclose it in response to Watch Your Assets’ Public Information Act request.

12 Watch Your Assets received this information from DeSoto through open record requests.

13 Land provided by the Terrell Economic Development Corp.

14 Watch Your Assets estimated future subsidy costs using 2008 tax rates and extrapolated tax-assessment values.

15 “Shopping for Subsidies: How Wal-Mart Uses Taxpayer Money to Finance Its Never-Ending Growth.” Good Jobs First. May 2004.

16 Carter & Burgess paid Texas lobbyists Joseph Bishop and James Shearer up to $25,000 apiece in 2007.

17 “Dallas Overcomes Budget Shortfall, Mayor Says,” McKee, Mary. Fort Worth Star-Telegram. February 5, 2003. http://findarticles.com/p/articles/mi_hb5553/is_/ai_n21752972

18 “Raise Taxes? No,” Dallas County Online. June 4, 2008.

http://www.dallascounty.org/department/comcrt/district2/archives.html

19 “Dallas school district budget crisis loomed for years.” Fischer, Kent. Dallas Morning News. December 19, 2008.

20 Dallas doled out 208 incentive deals, compared with 91 in Houston, 67 in San Antonio, and 19 in Austin. “Building a More Sustainable Economy,” for Livable City. Oden, Michael. May 2007. http://www.liveablecity.org/docs/LC_Incentive-Study.pdf

21 Wal-Mart’s distribution center in Dayton, Texas is in Liberty County—just outside of Houston’s Standard Metropolitan Statistical Area.

22 “NOW with Bill Moyers,” Public Broadcasting Service. December 19, 2003. http://www.pbs.org/now/transcript/transcript247_full.html

23 The City of Dallas, Montgomery County, Kaufman County/Terrell, and Johnson County/Cleburne deals allow for full recapture of all previous subsidies if Wal-Mart defaults on the deals. Montgomery County can cancel its deal if employment falls below 600 five times during a month.

24 The City of Sanger provided compliance reports that Wal-Mart submitted for the years 2005, 2007 and 2008. The City of Dallas provided compliance reports for the years 2004 through 2008 (complete with employment lists). The City of Sealy provided compliance reports for the years 2005, 2006 and 2008.

25 An Iowa State University study of Wal-Mart’s economic impact in Mississippi concluded that, “The net increases are minimal as the new big-box stores merely capture sales from existing business in the area.” See “Is Wal-Mart Too Powerful?” Bianco, Anthony and Wendy Zellner. Business Week. October 6, 2003. http://www.businessweek.com/magazine/content/03_40/b3852001_mz001.htm

26 “Hidden Cost of Wal-Mart Jobs: Use of Safety Net Programs by Wal-Mart Workers in California,” Dube, Arindrajit and Ken Jacobs. UC Berkeley Labor Center. August 2, 2004. http://www.dsausa.org/lowwage/walmart/2004/walmart%20study.pdf

27 “Is Wal-Mart Too Powerful?” Bianco, Anthony and Wendy Zellner. Business Week. October 6, 2003. http://www.businessweek.com/magazine/content/03_40/b3852001_mz001.htm

“Sandy Skrovan, vice president of Retail Forward, wrote in a special Retail Forward report called “Wal-Mart Food: Big, and Getting Bigger: The company's aggressive expansion will continue to wreak havoc and steal share away from conventional food, drug and mass retailers at an alarming pace.” “Superior Grocery Store to Close,” Duluth News-Tribune. July 9, 2005. http://www.redorbit.com/news/science/171026/superior_grocery_store_to_close

28“Who Calls the Shots in the Global Economy?” Smith, Hedrick. PBS Frontline: Is Wal-Mart Good for America? November 16, 2004. http://www.pbs.org/wgbh/pages/frontline/shows/walmart/secrets/shots.html

29 “NOW with Bill Moyers,” Public Broadcasting Service. December 19, 2003. http://www.pbs.org/now/transcript/transcript247_full.html

30 “NOW with Bill Moyers,” Public Broadcasting Service. December 19, 2003. http://www.pbs.org/now/transcript/transcript247_full.html “Georgia's program for uninsured children shows that it's packed with kids of Wal-Mart employees.” “Wal-Mart Stands Out on Rolls of Georgia’s PeachCare for Kids Health Insurance.” Miller, Andy. Atlanta Journal-Constitution. February 27, 2004. http://www.allbusiness.com/labor-employment/compensation-benefits-wages-salaries/10278826-1.html “Wal-Mart workers in California relied on 50% more taxpayer funded health care per employee than those at other large retail companies,” according to the Institute for Labor and Employment at the University of California, Berkeley.

31 Center for Public Policy Priorities. February 8, 2005. http://goodjobsfirst.org/pdf/texaschip.pdf

32 Gioia, John. Contra Costa County Supervisor. “NOW with Bill Moyers,” Public Broadcasting Service. December 19, 2003. http://www.pbs.org/now/transcript/transcript247_full.html