II. Lobby Clients

A. Texas Escalating Lobby Spending

B. The Nation's No. 2 State Lobby?

C. Million-Dollar Clients

D. Clients By Interest Category

Ideological and Single Interest Clients

Energy and Natural Resources Clients

Health Clients

Miscellaneous Business ClientsA. Texas' Escalating Lobby Spending

Over the past decade, special interests have spent between $1 billion and $2.3 billion on almost 65,000 Texas lobby contracts. As the accompanying table shows, lobby spending has increased over this period far more than the number of lobbyists, clients and contracts.

Texas’ Escalating Lobby Spending, (1995-2005)

Texas’ lobby spending peaks in odd-numbered years when the biennial Texas Legislature is in its regular session. With the exception of 1999, lobby spending has increased over time, regardless of whether you compare odd-numbered legislative years (solid bars) or even-numbered years that lack a regular legislative session (striped bars).1 Lobby spending for a given year peaks at the end of the year--after the last lobby reports are filed.

This report reveals the industries and clients that spent the most to influence public officials in 2005, as well as Texas’ top hired guns that year. As the accompanying graph shows, lobbying is a growth industry. Special interests spent up to $304 million on Texas lobbyists in 2005, up 77 percent from the $172 million maximum that lobby clients spent in 1995. (Exact contract values are unknown because Texas lobbyists report them in ranges such as “$50,000 to $99,999”). Governor Rick Perry made 2003 and 2005 banner lobbying years by convening three special sessions in 2003 and two additional ones in 2005. (For more on lobbying in the 2005 special sessions, see “Special Sessions for Special Interests.”)

of Contracts

of Contracts

Note: Data only include contracts with minimal values greater than zero.

*These totals would mislead since many lobbyists and clients reappeared each year.B. The Nation’s No. 2 State Lobby?

The adage “Everything’s bigger in Texas” is difficult to prove or disprove where lobby expenditures are concerned. A kaleidoscope of different state lobby reporting requirements subjects any state lobby ranking to numerous caveats. Undeterred, the Washington, D.C.-based Center for Public Integrity has ranked state lobby expenditures for several years. According to preliminary data compiled by the Center for a forthcoming report, Texas’ total 2005 lobby expenditures again rank No. 2 in the nation after California.

Yet this ranking contains important caveats. While California requires its lobbyists to report the actual value of their lobby incomes, Texas lobbyists report their incomes in ranges (e.g. $50,000 to $99,999). Notably, the Center bases its rankings on the total minimum value of Texas lobby contracts. If it used the total maximum value, Texas would surpass California’s lobby expenditures by more than $100 million. Texas braggarts also will note that the number of registered lobbyists and lobby clients in Texas exceeds that of California.

Top Lobby States in 2005

State California Texas New York Pennsylvania Massachusetts Source: Preliminary Center for Public Integrity data.

The Center’s Texas data differ from those used elsewhere in this report for a couple of reasons. First, the Center tracks a wider universe of lobby expenditures that includes the amount that special interests pay registered lobbyists (these data are analyzed in this report) along with the amount that those lobbyists spend wining and dining politicians (data not analyzed here). In addition, the Center tracks all lobby contracts whereas this report just tracks paid ones.

C. Million-Dollar Clients

Sixteen clients spent more than $1 million apiece by the end of the 2005 legislative session on 517 lobby contracts. As it has done each year for at least a decade, SBC Corp. (now AT&T) flexed Texas’ largest lobby muscle, spending up to $7 million on 129 paid contracts. In addition, several dozen SBC employees reported that they lobbied for their employer without compensation. One of these pro bono lobbyists was SBC Senior Vice President John Montford, a former state senator.

Million-Dollar Clients

Client Interest SBC Corp. (now AT&T) Communications TXU Corp. Energy TX Medical Assoc. Health Verizon Communications Linebarger Heard Goggan… Lawyers/Lobbyists Assoc. of Electric Co.’s of TX Energy CenterPoint Energy Energy City of Austin Ideological/Single-Issue Big City Capital LLC Miscellaneous Business TX Association of Realtors Real Estate City of Houston Ideological/Single-Issue TX Municipal League Ideological/Single-Issue TX Trial Lawyers Association Lawyers/Lobbyists AT&T Communications Entergy/Gulf States Inc. Energy Affiliated Computer Services Computers

SBC now has merged with AT&T, which spent another $1.1 million lobbying in Texas in 2005. Phone giant Verizon also spent more than $2 million. Boasting more lobbyists than Texas has lawmakers, these phone companies sought to deregulate what they can charge for the local phone monopoly that they control across much of the state. At the same time they demanded entry into television markets—without paying the local franchise taxes paid by the cable industry. This gambit floundered in the regular session, partly due to opposition from cable companies and municipal governments (three municipal interests surpassed $1 million in lobby spending). Yet the phone giants pushed their legislation through in one of the special sessions that Governor Rick Perry ostensibly convened in 2005 to tackle Texas’ school-funding crisis.Leading proposals to solve Texas’ school-funding conundrum involved either: Increased “sin taxes” on industries such as gambling (represented here by Big City Capital); or Closing business-tax loopholes. Professionals benefiting from these tax loopholes include law firms (represented here by Linebarger Heard Goggan et al. and the Texas Trial Lawyers Association) and real estate agents (represented by the Texas Association of Realtors).

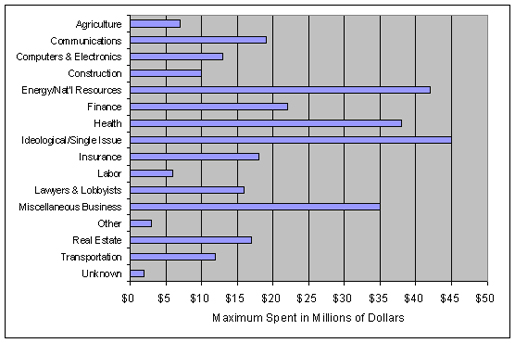

D. Clients By Interest Category

This report categorizes Texas’ 2005 lobby contracts by their underlying interests. Ideological & Single-Interest clients led the pack, accounting for 15 percent of all lobby money. The next largest categories—discussed below—were: Energy & Natural Resources; Health; and Miscellaneous Business.

Clients By Interest Category

Interest Group Agriculture Communications Computers/Electronics Construction Energy/Nat’l Resources Finance Health Ideological/Sing. Issue Insurance Labor Lawyers & Lobbyists Misc. Business Other Real Estate Transportation Unknown

Ideological & Single-Interest Clients

Local government interests dominated the No. 1-ranked Ideological & Single-Interest category. In 2005 these interests helped defeat legislation proposing a constitutional amendment to cap increases in property-tax appraisals. The Texas Association of School Boards similarly defended its interest in property tax revenue.2 Local governments initially fought the ultimately successful telecommunications legislation discussed above. That law lets phone companies sell television programming without having to negotiate franchise-tax deals with every local market they enter, as cable companies do.

Top Ideological & Single-Interest Clients*The EAA subsequently told TPJ that its lobbyists inflated its actual

Client City of Austin City of Houston TX Municipal League American Cancer Society Edwards Aquifer Authority Metro. Transit Authority of Harris Co. TX Civil Justice League Lower Colorado River Authority Harris Co. Commissioners Court TX Assoc. of School Boards Texans for Lawsuit Reform City of Texas City Cities Aggregation Power Project City of San Marcos

expenditure of "approximately $152,000" through duplicate reports of

the same contract amount.

During the 2005 session the American Cancer Society (ACS) failed to push through a $1-a-pack tax increase on cigarettes, a tax hike later approved in a 2006 special session. ACS successfully secured more funding in 2005 to compile statewide cancer-diagnosis data.The Texas Civil Justice League (TCJL) and Texans for Lawsuit Reform (TLR), two groups promoting legal limits on plaintiffs, collectively paid 31 lobbyists up to $1.3 million. In addition, TCJL’s Texas Asbestos Consumer Coalition paid 11 lobbyists (including former Lieutenant Governor Bill Ratliff) up to $280,000 more to promote limits on asbestosis and silicosis lawsuits. The passage of this bill (SB 15)—opposed by labor unions and trial lawyers—was the centerpiece of the business tort lobby’s 2005 session. TCJL and TLR (which runs Texas’ largest PAC) also championed a 2005 law that gives Texas judges greater discretion to refuse to hear cases filed by out-of-state plaintiffs (HB 755).

A couple of water agencies led by the Edwards Aquifer Authority (EAA) spent heavily on lobbyists. The EAA’s mandate requires it to supply historical water users with their accustomed supplies, even as it is supposed to safeguard the aquifer. Since aquifer users have grown accustomed to unsustainable water harvests, however, this mandate is contradictory. The EAA lobbied in 2005 to resolve this contradiction at the aquifer’s expense as part of a failed omnibus water bill (SB 3). It also fended off perennial proposals to strip Texas’ water authorities of their authority to regulate water quality.

Energy & Natural Resources Clients

Most of the top clients in the Energy & Natural Resources sector are nuclear powers. Ever since Texas lawmakers authorized Waste Control Specialists (WCS) to run two low-level nuclear waste dumps in West Texas in 2003, WCS has chased permits to expand the type, source and quantity of radioactive waste that it can dump there. In 2005 TXU, CenterPoint and American Electric Power all had stakes in Texas nuclear power plants. These plants and the Association of Electric Companies trade group long have sought a nuclear dumping ground.3

Top Energy & Natural Resources Clients

Entergy and Exelon are part of the Louisiana Energy Services (LES) consortium that wants to build a $1.2 billion uranium-enrichment plant in New Mexico—just over the border from WCS’ dumps. LES, which has pledged to dump an expected 217,000 tons of uranium waste outside New Mexico, has cited WCS as a promising destination.

Client TXU Corp. Assoc. of Electric Co’s of TX CenterPoint Energy Entergy/Gulf States, Inc. ExxonMobil Corp. Mesa Water, Inc. Citgo Petroleum Corp. American Electric Power TX Electric Cooperatives Constellation Energy Group El Paso Electric Co. Bass Enterprises Waste Control Specialists Shell Oil Co. Exelon Power TX Atmos Energy Corp. TX Rural Water Assoc.

Buoying the cliché that future Texas tycoons will make fortunes pumping water rather than oil, water interests floated near the top of the Energy & Natural Resources category. Leading the oil-to-water transition is Dallas energy tycoon T. Boone Pickens. His Mesa Water owns vast water rights in the Panhandle but has yet to find a cost-effective way to get this commodity to a major urban market. Mesa applauded passage of a 2005 bill increasing its due-process rights before groundwater conservation districts.4 The Texas Rural Water Association (TRWA) represents small water utilities in sparsely populated areas, including some encroached upon by urban sprawl. TRWA argues that if its members are to maintain service beyond subdivision utility districts they cannot be held to the same regulatory standards as high-density treatment plants. TRWA helped defeat 2005 legislation that would have further strengthened the position of urban areas in Texas’ water wars.5

Oil giants such as ExxonMobil helped promote the 2005 law limiting asbestos liabilities. Citgo also landed a $5 million grant in 2004 from Governor Perry’s Texas Enterprise Fund. The governor’s office credited the grant with luring Tulsa-based Citgo to Houston. Yet Citgo officials told the Dallas Morning News that they chiefly were motivated by a desire to be closer to their Gulf of Mexico refineries.Health Clients

The Texas Medical Association (TMA) dominated the health lobby again in 2005, waging largely defensive battles on behalf of physicians. Doctors euthanized proposals in that session to help fund public schools by taxing professional medical services. The TMA guild also beat back turf-war competition from other health professionals, including optometrists and podiatrists. TMA similarly won turf battles with the Texas Hospital Association and Texas Association of Health Plans. TMA lobbyists defeated proposals to: Ban physicians from owning specialty hospitals; and Bar out-of-network doctors from dunning patients for charges rejected by HMOs (including big lobby spenders Blue Cross, AmeriGroup and Aetna).

Top Health Clients

Client TX Medical Association TX Hospital Association Trinity Mother Frances Health System Blue Cross Blue Shield of TX Genzyme Corp. TX Association of Health Plans Pharmaceutical Research & Manufacturers TX Health Care Association E. TX Medical Center AmeriGroup Corp. Aetna, Inc. Girling Health Care, Inc.

Genzyme Corp. and its trade group, the Pharmaceutical Research and Manufacturers Association, have opposed efforts to let U.S. consumers import cheaper drugs from Canada. A 2005 law enacted by Texas’ cash-strapped government would have created a program to do just that (SB 410). Texas Attorney General Greg Abbott blocked the law from taking effect, ruling that federal prohibitions on drug imports trump state law.Girling Health Care and other nursing home interests represented by the Texas Health Care Association failed to push through a bill that would have increased billings for Medicaid patients.

Miscellaneous Business Clients

The legislature’s efforts to simultaneously relieve property taxpayers and increase school funding accounts for many of the largest Miscellaneous Business lobby expenditures. Texas’ Republican leadership sought to accomplish this feat in 2005 through increased “sin taxes.” The boldest proposals to do this would have legalized whole new sins for the state to tax. Gambling interests tapped this fever, begging lawmakers to create a tax gravy train by legalizing casinos or slot machines.

Big City Capital led the gambling charge. Its creator is Billy Bob Barnett, founder of the eponymous Billy Bob’s honky tonk in Fort Worth. Barnett previously tried to open a Vegas casino and his business partner, Holt Hickman, has long sought to bring casino gambling to his Fort Worth Stockyards. Hickman is an investor in a company seeking to build a horse track near the capital. Texas racetrack interests—including Gulf Greyhound—want legal authority to install slot machines (such as those sold by Multimedia Games) at their tracks.

Top Miscellaneous Business Clients

Client Big City Capital, LLC Wholesale Beer Distributors of TX Multimedia Games, Inc. Let The Voters Decide Distilled Spirits Council of the U.S. TX Retailers Assoc. HE Butt Grocery Co. Steel Manufacturers & Recyclers of TX Kraft Foods TX Package Store Assoc. Landry's Restaurants, Inc. Administaff, Inc. LeapFrog Enterprises, Inc. Learning.com Gulf Greyhound Partners Ltd.

Houston-based Landry’s Restaurants, which has casino interests in Nevada, would like to develop more of them back home. A gambling industry group, Let the Voters Decide, lobbied for a state ballot initiative to put the casino question directly before Texas voters.While gambling interests begged lawmakers to expand—and tax—their industry, the alcohol industry (led by the Wholesale Beer Distributors, Distilled Spirits Council and Texas Package Store Association) drowned proposals to fund schools through alcohol tax hikes. Any increased funding for Texas schools could be a boon for for-profit educational companies, including big lobby spenders LeapFrog Enterprises and Learning.com.

©Copyright Texans for Public Justice, August 2006