II. Lobby Clients

A. Recession Hits Texas Lobby

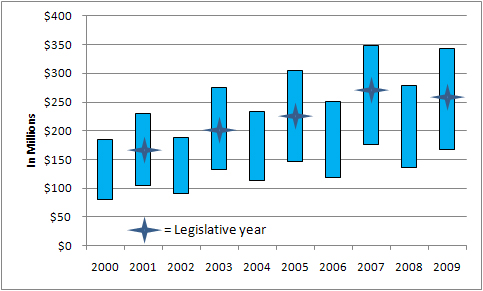

This report reveals the clients and industries that spent the most to influence state officials in 2009, as well as Texas’ top hired guns (exact contract values are unknown because Texas lobbyists typically report them in ranges such as “$50,000 to $99,999”). Special interests have spent up to $2.6 billion on more than 65,000 Texas lobby contracts over the past 10 years. Texas lobby spending peaks in odd-numbered years when the biennial legislature convenes its regular sessions. Apart from 2009, lobby spending increased over the past decade, regardless of whether you compare odd-numbered legislative years or the even-numbered years that lack a regular legislative session. Then the global recession pushed 2009 lobby expenditures below what they were during the previous legislative year. From 2007 to 2009, the number of lobbyists and clients inched up, even as the number of lobby contracts and total lobby spending dipped. Nonetheless, Texas’ top lobbyists are making more money than ever.

Recession Hits the Texas Lobby

of Contracts

of Contracts

Contracts

Lobbyists

ClientsNote: Data cover contracts with minimal values greater than zero

and reflect year-end numbers, when lobby data tend to peak.

*These totals would mislead since many lobbyists and clients reappear each year.

B. Million-Dollar ClientsBy the end of 2009, 27 clients spent more than $1 million apiece on 615 lobby contracts (down from 31 whopper clients in 2007). Collectively these 27 mega-clients paid lobbyists up to $47 million, accounting for a remarkable 14 percent of all the money spent on Texas lobbyists. As usual, AT&T flexed Texas’ largest lobby muscle, spending up to $9.3 million on 117 contracts.

Million-Dollar Clients

Client

of Contracts

ContractsInterest Group AT & T Corp. Communications Energy Future Holdings Corp. Energy/Natural Res./Waste Reliant Energy, Inc. Energy/Natural Res./Waste McGinnis, Lochridge & Kilgore Lawyers & Lobbyists TX Trial Lawyers Assn. Lawyers & Lobbyists American Electric Power Energy/Natural Res./Waste TX Assn. of Realtors Real Estate TX Medical Assn. Health TXU Energy Retail Co. Energy/Natural Res./Waste CenterPoint Energy Energy/Natural Res./Waste Oncor Electric Delivery Co. Energy/Natural Res./Waste Assn. of Electric Co’s of TX Energy/Natural Res./Waste City of Houston Ideological/Single Issue Wholesale Beer Distributors of TX Miscellaneous Business Baker Botts Lawyers & Lobbyists ExxonMobil Corp. Energy/Natural Res./Waste El Paso County Ideological/Single Issue TX Cable & Telecom. Assn. Communications Linebarger Heard Goggan Blair… Lawyers & Lobbyists Verizon Communications Luminant Holding Co. Energy/Natural Res./Waste RRI Energy, Inc. Energy/Natural Res./Waste City of Austin Ideological/Single Issue Atmos Energy Corp. Energy/Natural Res./Waste Henderson Global Investors, Inc. Finance Locke Lord Bissell & Liddell Lawyers & Lobbyists UnitedHealth Group Health

C. Top Clients By Interest Category

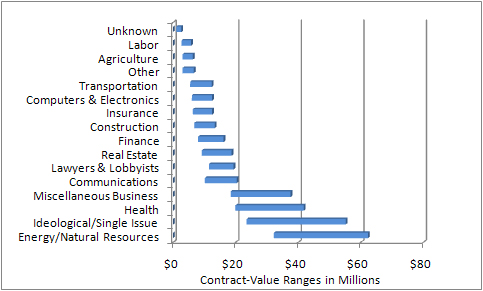

This report categorizes Texas’ 2009 lobby contracts by their underlying interests. Energy & Natural Resources clients led the herd. They accounted for 18 percent of all lobby expenditures, spending up to $62 million. Ideological & Single-Interest clients consumed 16 percent of the lobby pie, spending up to $55 million. The Health and Miscellaneous Business sectors were the next-biggest spenders.

Clients By Interest Category

Interest Group

of Contracts

of Contracts

Contracts

Max. ValueEnergy/Natural Res./Waste Ideological/Single Issue Health Miscellaneous Business Communications Lawyers & Lobbyists Real Estate Finance Construction Insurance Computers & Electronics Transportation Other Agriculture Labor Unknown

1. Energy & Natural Resources: Up to $62 Million

The up to $62 million spent by Energy & Natural Resources clients accounted for 18 percent of all lobby spending. Energy Future Holdings Corp., formed by the 2007 buyout of TXU Corp., led this industry and ranked No. 2 overall, behind behemoth AT&T. Yet three Energy Future subsidiaries (TXU, Oncor and Luminant) also spent more than $1 million apiece on lobbyists. Taken together, Energy Future and its appendages spent up to $7.3 million on lobbyists in 2009.

Texas accounts for half of the 10 worst coal plants in the nation in terms of preventable mercury emissions, according to a recent report by the Environmental Integrity Project.1 Energy Future owns three of the beasts. The other two are owned by two other big Texas lobby clients: NRG and American Electric Power. Mercury exposure retards the development of children’s brains.

The Texas Public Utility Commission (PUC) awarded $5 billion in contracts in 2009 to build new electric transmission lines to move wind power from West Texas to big cities to the East. It awarded the biggest contract—for $1.3 billion—to Energy Future’s Oncor unit. The PUC gave the No. 2 contract to a joint venture involving American Electric Power. The Lower Colorado River Association landed the No. 3 contract (LCRA’s lobby contracts are classified in the Ideological and Single-Interest category). The PUC awarded smaller contracts to several customer-owned electric co-ops represented by Texas Electric Cooperatives trade association.

Top Energy & Natural Resources Clients

Client

of Contracts

of Contracts

ContractsEnergy Future Holdings Corp. Reliant Energy, Inc. American Electric Power *TXU Energy Retail Co. CenterPoint Energy *Oncor Electric Delivery Co. Assn. of Electric Companies of TX ExxonMobil Corp. *Luminant Holding Co. RRI Energy, Inc. (formerly Reliant) Atmos Energy Corp. TX Electric Cooperatives Exelon Power Entergy Corp. NRG Energy, Inc. TX Oil & Gas Assn. City Public Service of San Antonio Shell Oil Co. Direct Energy, LP (unit of Centrica) Fort Concho Gas Storage, Inc.2 Waste Control Specialists, LLC Steering Com. of Cities Served by Oncor *Unit of Energy Future Holdings Corp.

2. Ideological & Single-Issue: Up to $55 Million

Ideological & Single-Issue clients spent up to $55 million, accounting for 16 percent of all lobby spending. Local government interests dominated this category in their competitive quest for scarce state and federal funds. Just 8 percent of city-related bills passed the 2009 session, according to the Texas Municipal League. The league celebrated this body count, since most bills that would affect its members “would have harmed municipal authority.” The Texas Association of Counties similarly celebrated failed legislative efforts to “further restrict property tax revenue or lower appraisal caps.”

The largest private entity in this category, Texans for Lawsuit Reform (TLR), dubbed 2009 its “hardest” session, as trial lawyers “made a broad attack against lawsuit reforms.” Not to worry: TLR and its business buddies parried every thrust. TLR targeted a bill that would have reversed an activist 2007 Texas Supreme Court ruling that shields owners of large industrial plants from accountability for injuries to contract workers.3 TLR also helped kill a bill to define a standard for what asbestos victims must prove to recover mesothelioma claims.4

The American Cancer Society pressed lawmakers to fully fund the $3 billion Cancer Prevention and Research Institute of Texas, which Texas voters approved in 2007. It also helped restrict the use of tanning parlors by minors5 but struck out on efforts to ban smoking in public spaces and workplaces.6 Tobacco companies (classified in Agriculture) spent up to $3 million on 50 Texas lobbyists in 2009. Texas’ top tobacco lobbyist was David Sibley, who is running for his old seat in the Texas Senate. Lorillard and Swedish Match paid Sibley up to $250,000.7

Top Ideological & Single-Issue Clients

Client

of Contracts

of Contracts

ContractsCity of Houston El Paso County City of Austin Port of Houston Authority TX Municipal League Texans for Lawsuit Reform American Cancer Society National Rifle Assn. City of San Antonio TX Assn. of Counties Cities Aggregation Power Project City of Dallas TX Charter Schools Assn. Raise Your Hand for Public Schools Harris County TX Business for Clean Air Lower Colorado River Authority Tarrant Regional Water District TX Assn. of School Boards

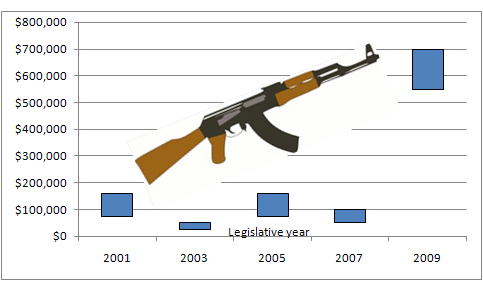

Although this is not one of its battleground states, the National Rifle Association’s agenda expired in the Texas Legislature’s cold, dead hands in 2009, as four NRA priority bills got jammed in legislative chambers. The NRA’s “top legislative priority,” which could be called the “Going Postal Bill,” would’ve given employees the right to store guns and ammo in their cars while at work.8 Other pistol-whipped Second Amendment bills would’ve allowed concealed handguns on campuses9 and repealed an onerous requirement that requires concealed-weapon licensees to present their gun licenses if stopped by cops.10 (For more on the NRA, see the section on the “Fattest Lobby Contracts.”)

Texas Lobby Spending By the NRA

AK-47 courtesy of the late Soviet Union.3. Health: Up to $42 Million

Health industry clients spent up to $42 million, accounting for 12 percent of all lobby spending. The Texas Medical Association (TMA) and UnitedHealth Group topped the charts, as doctors and health insurers increasingly clash in the lobby. Represented by the Texas Association of Health Plans, insurers killed a TMA-backed “Health Insurance Code of Conduct,” which would have prohibited insurers from denying benefits based on misrepresentations or preexisting conditions.11 TMA and the American Cancer Society (see previous section) both helped pass bills that require insurers to: 1. Pay for some participants in experimental clinical trials; and 2. Cover oral chemotherapy at the same rate as intravenous chemo.12

Manufacturers of drugs and medical devices helped bottle up a legislative prescription to require them to publicly disclose the gifts that they give to health care providers to stimulate sales of their products.13 Opponents of the bill included drug companies, implant maker Medtronic and the Texas Association of Manufacturers.

Top Health Clients

Client

of Contracts

of Contracts

ContractsTX Medical Assn. UnitedHealth Group Blue Cross & Blue Shield TX Hospital Assn. Medtronic, Inc. TX Assn. for Home Care TX Assn. of Health Plans AMERIGROUP Corp. TX Pharmacy Business Council Merck Sharp & Dohme Corp. East TX Medical Center Teaching Hospitals of TX Superior HealthPlan, Inc. TX Children's Hospital Pharm. Research & Manfrs. of America TX Dental Assn. Eli Lilly & Co.

4. Miscellaneous Business: Up to $38 Million

The diverse clients falling into the Miscellaneous Business sector spent up to $38 million, accounting for 11 percent of all lobby spending. Some of the biggest spenders in this category were alcohol and gambling interests.

Alcohol interests have been brawling over whether or not Texas should scuttle its archaic regulatory system which generally requires retailers to buy alcoholic beverages from local wholesalers. Critics want to overthrow these restrictions—recently upheld by the U.S. 5th Court of Appeals—to promote competition and consumer choice.14

Racetrack interests have argued for years that they will not survive without authorization to install slot machines. In fact, the parent company of MEC Lone Star went bankrupt in 2009, selling its interest in Grand Prairie’s Lone Star Park to the Chickasaw Nation.15 One reason why gambling-expansion proposals failed again in 2009 is that racetracks continue to fight over the projected spoils with casino interests such as the Texas Gaming Association and Landry’s Restaurants (which owns casino interests in Nevada). 16

Miscellaneous Business

Client

of Contracts

of Contracts

ContractsWholesale Beer Distributors of TX TX Package Stores Assn. TX Assn. of Manufacturers Gtech Corp. HE Butt Grocery Co. Silver Eagle Distributors [beer] TX Retailers Assn. Pearson Education Landry's Restaurants Anheuser-Busch InBev Worldwide Assn. of FundRaising Distributors of Suppliers Gulf Greyhound Partners Henderson Controls, Inc. Mary Kay Cosmetics, Inc. Licensed Beverage Distributors Rent-A-Center GEO Group, Inc. Diageo College Network MEC Lone Star TX Gaming Assn.

Gtech Corp. has had the contract to operate the Texas Lottery since its inception. In 2008 the Texas Lottery Commission hired another firm, Gartner, Inc., to help design the procedures to rebid Gtech’s lucrative contract. The Lottery Commission later learned that Gartner violated this contract by working for Gtech while it worked on the bidding procedures. Lottery Commission officials concluded in March that there was “no evidence of any actual conflict of interest” as a result of Gartner’s dual roles.17

Henderson Controls began hiring lobbyists—including former lawmaker Ray Allen—in 2008. Henderson’s air-conditioner components are assembled by inmates at a Lockhart prison run by the Geo Group (another major lobby client listed above). As vice chair of the House Corrections Committee, then-Rep. Allen wrote the 1997 bill that created the Private Sector Prison Industries Oversight Authority to oversee companies using prison labor.18 Doubts about the authority’s oversight prowess arose after a 2007 raid of a Farmers Branch company that employed Texas prisoners to build custom cars. Police reported that the company’s prison workers illegally stripped Vehicle Identification Numbers from cars, prompting one prisoner to dub the operation a taxpayer-subsidized “illegal chop shop.”19 Concerned that the Oversight Authority may not prevent prisoners from taking the jobs of law-abiding Texans, lawmakers abolished the oversight authority last year, transferring its responsibilities to the Texas Board of Criminal Justice (HB 1914). One witness who opposed this bill was Henderson Controls President Randall Henderson, whom Governor Perry appointed to the oversight authority in 2008.20 Several ex-cons testified at the hearing that their prison jobs with Henderson Controls turned their lives around.

©Copyright Texans for Public Justice, May 2010